- Free Consultation: (212) 693-3737 Tap Here to Call Us

Irrevocable Trusts – Good and bad

One of the most important tools in estate planning is a trust. A trust allows the settlor—or the creator of the trust—to control the distribution of his property either during his lifetime or after his death. The trustee, is tasked with holding the property for the beneficiary’s benefit and distributing that property in accordance with the terms of the trust.

There are many different types of trusts. But more broadly, every trust is either revocable or irrevocable. Unless the drafter of the trust explicitly says so, a trust is irrevocable

There are advantages and disadvantages of each kind of trust. The irrevocable trust offers an estate plan more utility and protection from creditors than a revocable trust would. irrevocable trusts offer asset protection, the ability to reduce estate taxes, and enables the settler to be eligible for Medicaid funds.

Should your primary concern be your ability to keep and stay in your home during your lifetime and that of your spouse, creating an irrevocable trust, with provisions allowing you to stay in your home, is a good solution. Creating an irrevocable trust secures your right to live in your home and avoid probate taxes for your heirs after you die. However, if at some point decide to sell your home, the irrevocable trust may eliminate that option.

Your creditors will be unable to reach the assets of an irrevocable trust that you create so long as there is no evidence of overt fraud or debt avoidance. This makes an irrevocable trust a powerful tool to still provide for your loved ones, despite having burdening debts on your finances. Moreover, this even includes the creditors of a beneficiary of the irrevocable trust. If the beneficiary has little or no control over the assets of the trust, the creditors will be unable to reach those assets.

An irrevocable trust also will minimize estate taxes by allowing a surviving spouse to obtain a federal estate tax exemption on the assets you placed in the irrevocable trust. The only caveat there is that the assets of the trust may still be taxed as a gift when the trust is created if the assets exceed the allowable threshold.

An irrevocable trust will also comply with Medicaid laws to ensure the settler may be eligible to receive benefits. Under the Medicaid laws, assets held in a revocable trust—assets that you can withdraw or seek benefits from—remain part of the settlor’s estate. Thus, you will remain eligible for Medicaid despite having significant funds in an irrevocable trust.

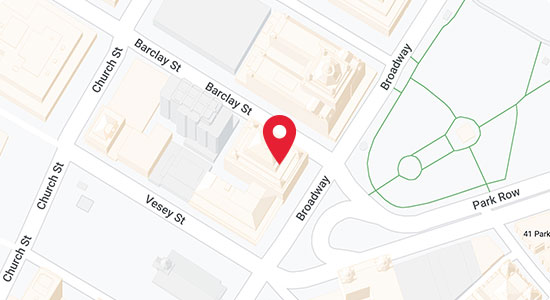

Because of the many nuances and complex laws in this area of law, it is essential that you retain a New York trusts attorney